Much is expected of Samsung, especially in their smartphone division. But the success of their Galaxy series doesn’t always translate into market performance. They have sold hundreds of millions of handsets, but their share value sometimes feels like it hasn’t fluttered an eyelid. Why not? What is really going on to affect market value and performance of a company like Samsung?

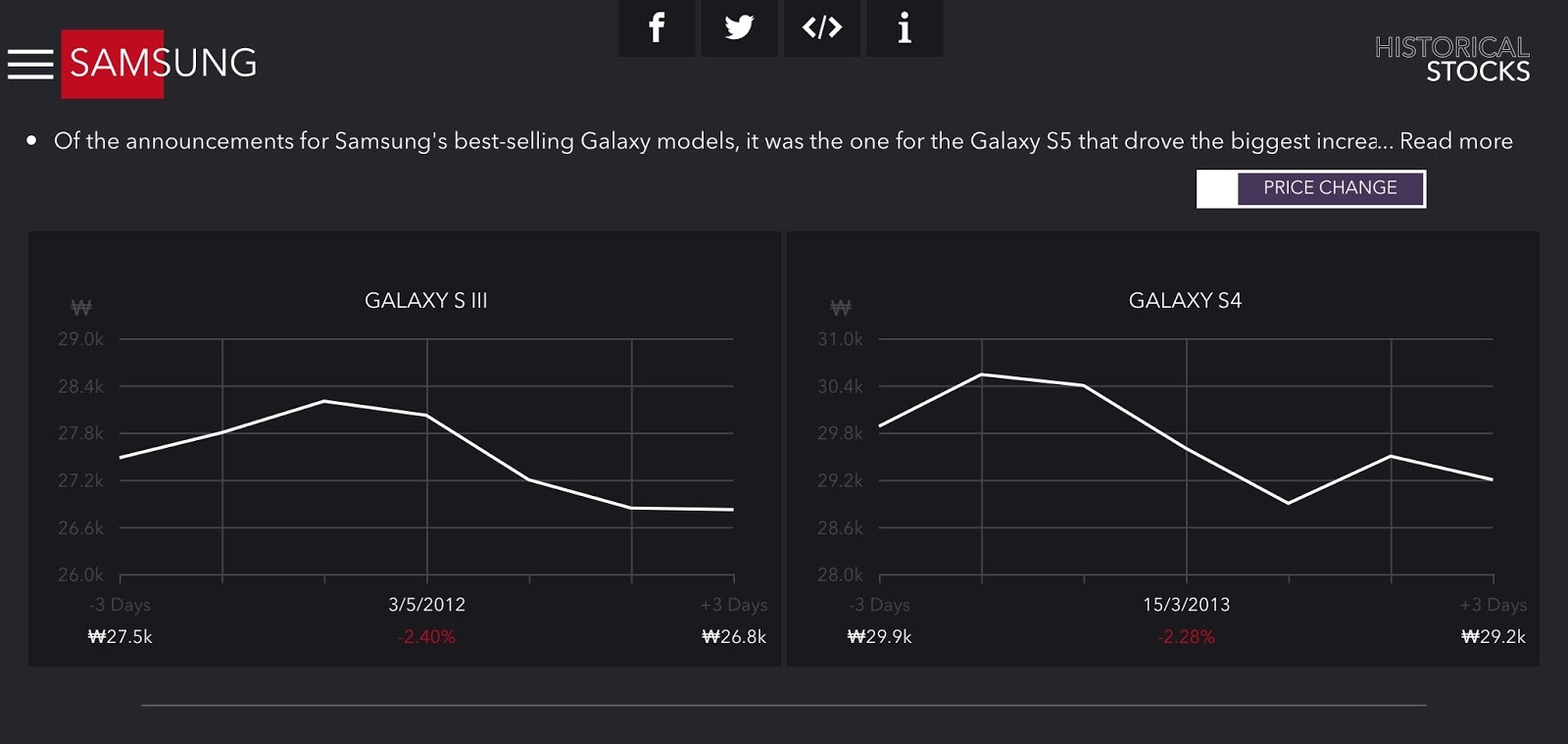

The biggest selling smartphone releases of all time include the Galaxy S3, released in 2012, which managed sales figures of over 70 million units. Just a year later it’s successor, the Galaxy S4, improved on that figure, selling over 80 million units.

The S4 managed to stand out from the crowd with innovative smartphone features like Touchwiz, eye tracking and hover touch, helping it do more than its competitors. But when the S4 was released, Samsung stock price actually fell by 2.3%. This seems counterintuitive, but there are a number of factors to consider when it comes to smartphone company value; it’s not always about the number of phones sold.

Samsung: An investor’s viewpoint

Variations in price expectations, retail quantity, innovation and market expectancy have always sparked the interest of technology share traders, especially when it comes to contracts for difference (CFDs). Their aim is to analyse these markets and buy or sell CFD positions, speculating on price movements in either direction. Their chances of gaining ultimately rely on the extent to which their forecasts are correct.

There is a lot more going on to influence share prices than just retail domination too. So, if the success of a company, and specifically their share price movement, is to indicate anything, it isn’t always the number of phones they have shipped.

Samsung itself should be considered a much broader barometer for the entire electronics and technology industry. It manufactures smartphones, LCD screens, memory chips, semiconductors, home appliances and a multitude of other components too. Since 2006, it has been the world’s leading television manufacturer and the third largest technology company in terms of revenue.

What is going on that influences Samsung share price?

There are a number of factors that influence decisions to hold or sell positions on smartphone makers. Their shares are just small chunks of a company, but what makes those chunks worth more or increase in value?

Share prices are just a reflection of investor expectations. In Samsung’s case, it is often reflective not of the smartphone side of their business, but the heart of the company itself. While smartphones are the more eye-catching side of the wider electronics market, it’s by no means the most profitable. For instance, mobile contributed just 16% of Samsung's operating profit in 2017.

If Samsung pushed out 100 million new Galaxy S10 phones, the share price still might not move. This is because the market has already accounted for the expectation of shifting 100 million units, and the share value is already reflected in today’s price.

So, if Samsung does better or worse than the market expects, then share prices will move. The actual number isn’t as important as its performance against retail predictions. What you can be sure of is that those looking to make financial gains by speculating on share price movements will take a close look at the development of technology in the smartphone world, such as its AR and VR innovations, but they will take a greater look at the wider company picture.