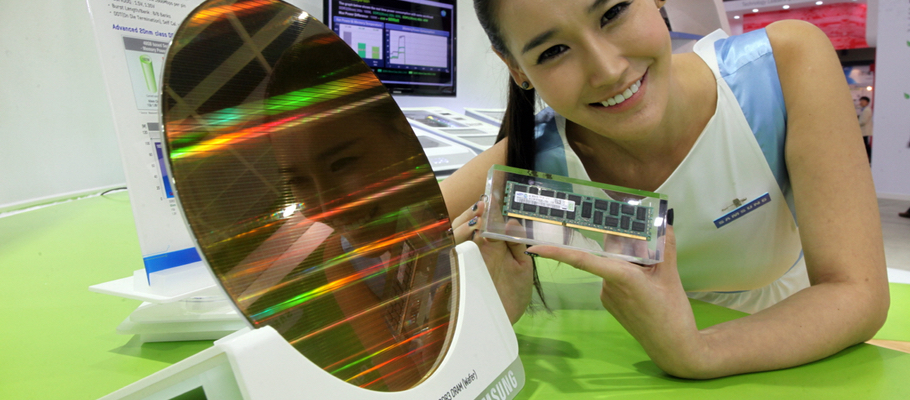

Samsung's components business has proven to be a veritable cash cow for the conglomerate. The company already accounts for almost half of the global DRAM market. This is a position that it certainly wants to hold on to. As smaller rivals position themselves to take on Samsung, the company wants to effectively crush them with a massive surge in spending.

According to market analyst IC Insights, Samsung's plan to maintain its dominance in this key market has involved doubling its capital expenditure in the semiconductor division for this year.

Show me the money

Samsung's capital expenditures for the semiconductor division clocked in at $11.3 billion last year. It more than doubled the capital expenditure for the division to an unprecedented $26 billion this year.

$14 billion of that has been allocated to a significant capacity increase at Samsung's Pyeongtaek fab. Samsung allocated $7 billion for process migration and further capacity increase. It also spent $5 billion to ramp up the 10nm process capacity.

The $8.6 billion that Samsung has spent on semiconductors in Q4 2017 this year accounts for 33 percent of the $26.2 billion capex that the industry as a whole spent during this period.

The surge in spending will enable the semiconductor division to further expand its development and production capabilities. It's a preemptive measure by the company against the rise of potential competitors from China.

China buys almost a fifth of the global DRAM supply. It has funded the creation of domestic memory producers to reduce imports and establish Chinese presence in the semiconductor industry.

Samsung's massive surge in spending is going to make that difficult for the Chinese rivals. It's virtually impossible for them to compete at the same level unless they establish a joint venture with an existing large memory supplier.

Analysts believe that this surge in spending can cause problems in the future. It may lead to a supply glut in the 3D NAND flash market as major rivals SK Hynix, Toshiba, Intel and Micron have also increased spending.