Samsung dominated the smartphone memory chip market in 2019, even though industry-wide revenues have declined for both NAND and DRAM. However, Samsung maintained its top spot in the smartphone memory segment throughout the year and has secured 47% revenue share.

Samsung's smartphone memory solutions account for roughly 50% of the market

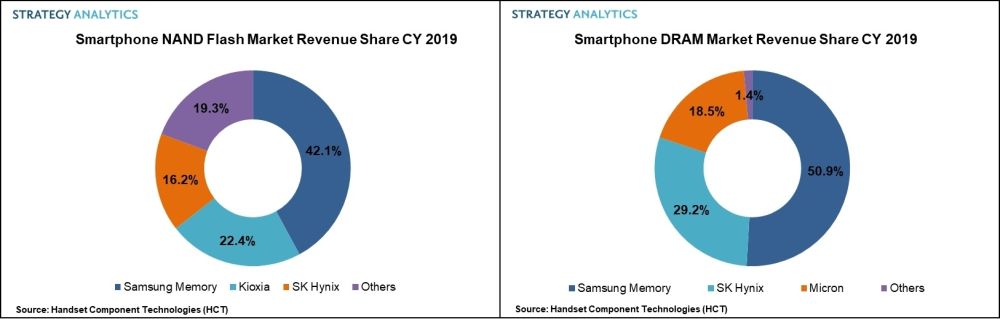

According to Strategy Analytics, demand for smartphone NAND Flash declined in 2019, and likewise, revenues saw a drop of 29% year-over-year. But Samsung remained the top dog in the smartphone NAND Flash segment and has recorded a revenue share of 42.1%. The Korean tech giant was followed by Kioxia and SK Hynix in 2nd and 3rd places.

Similarly, demand for smartphone DRAM also saw a decline of 27% year-over-year. An oversupply led to a fall in memory chip prices, but according to market analysts, Samsung's successful design drove the company's revenues. Samsung recorded a revenue share of 50.9% in the smartphone DRAM segment in 2019 and was followed by SK Hynix (29.2%) and Micron (18.5%).

Demand for newer memory technologies should rise

2020 will be a more difficult year for Samsung and its rivals, as the COVID-19 pandemic continues to disrupt businesses big and small. The global smartphone production is expected to decline, but the lower demand for existing memory solutions could be offset by increasing demand for LPDDR5 and UFS 3.0 memory chips. Samsung also began mass-producing 512GB eUFS 3.1 storage chips last month, so the company's memory business is as future-proof as it can be at this point.

Samsung's data center chip sales also seem to have cushioned the lower demand for smartphones over the past few months, but time will tell if this trend will continue in the following quarters.